Email Updates

-

Recent Posts

Links

Tags

37.5 Hour Week AXA Insurance AXA Miles AXA Tech Ballot Bancassurance Bullying Claims Commercial Lines Coronavirus Derry Equality & Diversity European Works Council Facebook Flexible Working Flexitime Friends Life health and safety Holiday job losses Northern Ireland Overtime Pay 2011 Pay 2012 Pay 2013 Pay 2014 Pay 2015 Pay 2016 Pay 2017 Pay 2018 Pay 2020 Pay 2022 Pensions performance management Personal Lines Phoenix Political Fund Standard Life Swiftcover TUC Union Reps Wealth Work/Life Balance Working from Home Working Hours

The web-site for Unite members employed by AXA UK…

Anon Said,

February 16, 2023 @ 12:50 pm

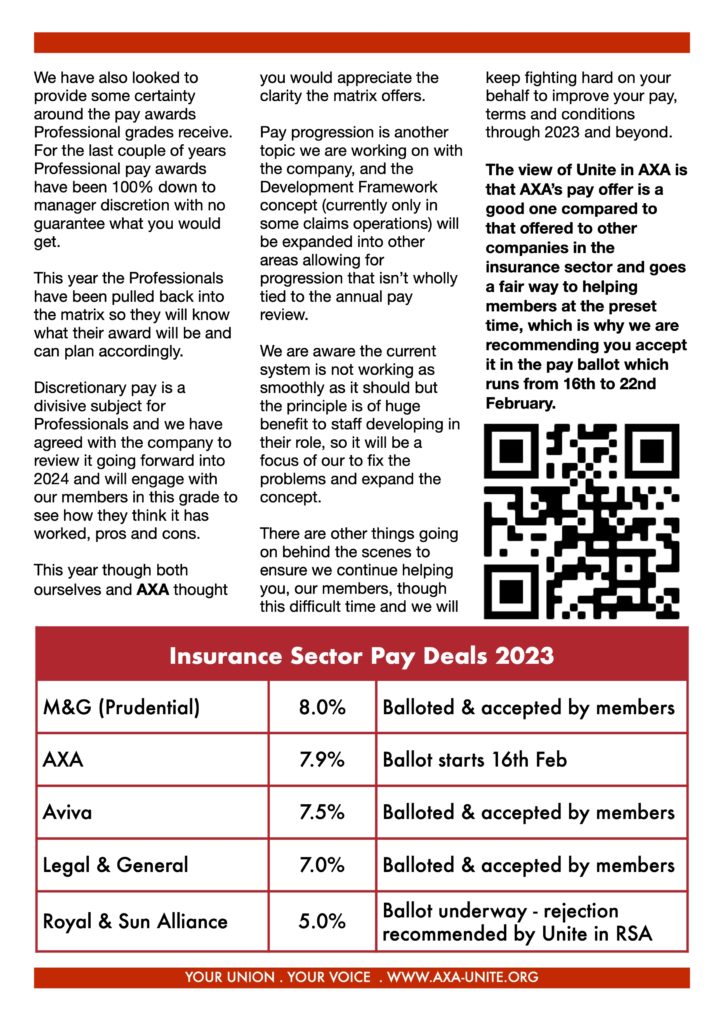

The comms on this are totally misleading. You ask us to vote on a 7.9% pay rise when the actual figure is 7% putting us joint second to last on the list.

Incorporating other items into the figure to bump it up and try to make it more appealing is just deceptive.

steveblease Said,

February 16, 2023 @ 1:17 pm

The actual spend amount is 7.9%, the matrix alone is part of that spend costing 7%. If the Hybrid Working Allowance money was not being spent as is but consolidated into the matrix the overall amount would have been 7.5% as the company would have to pay tax and NI (therefore reducing the amount you get) so we thought this a better approach to maximise the amount of money reaching staff. Proportionally it was better for lower paid staff than an across the grades pot. The other company figures also include non-consolidated elements so it is comparing oranges with oranges not pears, no deception.

Anon Said,

February 16, 2023 @ 3:14 pm

Could you explain what the other 0.4% is accounted for please? I understand 7% matrix 0.5% hybrid working allowance, where is the rest being applied to?

steveblease Said,

February 16, 2023 @ 3:58 pm

If the HWA was put into the Matrix instead the value of the total spend would be reduced as a chunk is lost in tax and National Insurance by both employee and employer (so the money is worth 0.9% as the allowance but only 0.5% if put in the matrix instead).

Also if the percentage would be the same for a higher paid worker, they would get more in pounds than they do with the HWA. £6 a week for someone on £25k being a higher % than the same £6 for someone on £50k for example whereas 0.5% extra for each is £125 for the lower paid, £250 for the higher.

anonn Said,

February 16, 2023 @ 4:50 pm

you cant really include the work from home allowance in the 7.9%, we already receive this so its not a raise, its just avoiding a reduction to something we are able to claim from HMRC anyway as a tax relief (granted that works out slightly less than axa paying it)

steveblease Said,

February 16, 2023 @ 5:08 pm

We only negotiated it for six months last year and it was due to end 31st March. Its now will continue as long as the HMRC scheme is in place. Also it is NOT the same as the tax relief you could claim (it is worth three times as much).